Our Appraisers

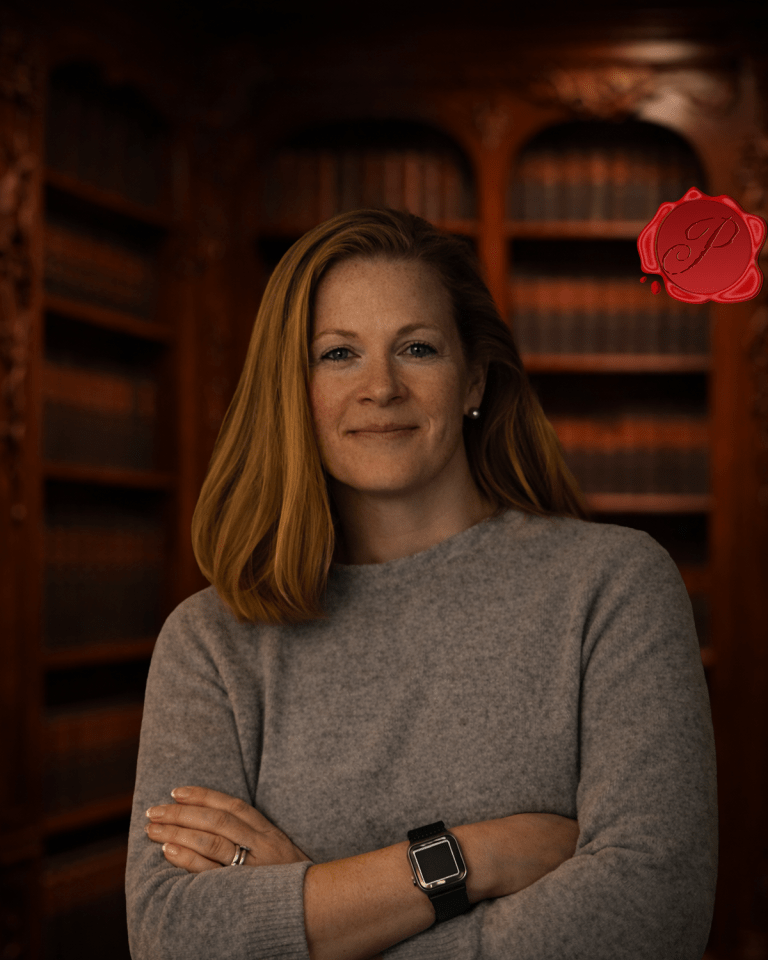

Alicia Weaver

1-844-ITEM-VAL (1-844-483-6825)

President - Appraisal & Valuation Division ISA C.A.P.P.

Phone: 1-844-ITEM-VAL (1-844-483-6825)

Email: Appraisals@PrestigeEstateServices.com

Website: www.PrestigeEstateServices.com

Meet Alicia Weaver, ISA-C.A.P.P.: President of Prestige Estate Services’ Appraisal & Valuation Division

Alicia Weaver is an internationally recognized Certified Appraiser of Personal Property (C.A.P.P.) accredited by the International Society of Appraisers (ISA)—one of only 108 appraisers in North America to hold this prestigious credential. With more than 20 years of experience, Alicia has devoted her career to delivering professional, transparent, and ethically driven property appraisals. As President of the Appraisal & Valuation Division at Prestige Estate Services, she oversees a nationwide team of USPAP- and IRS-qualified appraisers, consistently raising the industry’s standards for accuracy and client satisfaction.

Expertise & Industry Leadership

High-Net-Worth Client Specialization

For the past 15 years, Alicia has focused on serving high-net-worth clients—coordinating with estate attorneys, trust companies, wealth managers, insurance companies, and CPAs to deliver appraisal services essential for:

- Donation & Charitable Contributions

- Division of Assets & Equitable Distribution

- Estate Tax Filings

- Insurance Claims & Coverage

ISA Private Client Services

Alicia’s involvement with ISA Private Client Services underlines her expertise in catering to the specialized needs of affluent clients. She provides tailored appraisals, handles complex inventory & valuation processes, and has earned a reputation as one of the most sought-after professionals in the personal property appraisal field.

20+ Years of Industry Experience

Before establishing Prestige Estate Services in 2010, Alicia honed her skills through entrepreneurial ventures and a dedication to higher education, including her degree from the University of Colorado at Boulder. Today, her knowledge encompasses antique furniture, fine art, and general personal property appraisals—making her a go-to resource for clients seeking rigorous valuations and market insights.

Prestige Estate Services: Founded by Alicia Weaver

Alicia launched Prestige Estate Services in 2010 to bring a new level of professionalism and transparency to the personal property appraisal industry. Under her guidance, the company has grown exponentially, serving strategic markets nationwide, including:

- Denver, CO

- Aspen/Vail, CO

- Colorado Springs, CO

- Jackson, WY

- Fort Myers, FL

- Sanibel, FL

- Naples, FL

- Sarasota, FL

- Tampa, FL

- Tallahassee, FL

- Orlando, FL

- West Palm Beach, FL

- Jacksonville, FL

- Honolulu, HI

- Minneapolis, MN

- Des Moines, IA (and Northern Iowa)

- Richmond, VA

- Columbus, Cincinnati, Cleveland, OH

- Tucson, AZ

- And more…

Through expanding geographic reach and continuous professional development, Prestige Estate Services stands out for detailed appraisals spanning personal property, fine art, antiques, and more.

Services & Specialties

Alicia and her team at Prestige Estate Services adhere strictly to USPAP (Uniform Standards of Professional Appraisal Practice), ensuring that each valuation is credible, objective, and widely accepted for legal, financial, and personal needs. Key service areas include:

-

Estate Evaluations & Probate

- Comprehensive inventories, fair market value assessments, and IRS-compliant documentation to streamline estate settlements.

-

Estate Tax & Division of Assets

- Detailed appraisals essential for equitable distribution in family, trust, or divorce scenarios.

- Estate tax valuations safeguard against inaccuracies during IRS filings.

-

Insurance Claims & Coverage

- Damage claim appraisals for fire, flood, or theft losses, plus replacement cost analyses to help clients secure adequate coverage.

-

Non-Cash Charitable Donations

- Tax-deductible gift appraisals aligned with IRS Publication 561, allowing donors to claim appropriate credits.

-

Brokerage & Consulting

- Assistance with selling high-value property, including referrals to reputable auction houses or private buyers.

- Consultant services for individuals or institutions seeking guidance on collection management or liquidation strategies.

-

Expert Witness & Instruction

- Courtroom testimony for contested appraisals in litigation, as well as educational seminars on personal property appraisal and USPAP compliance.

Why Clients Trust Alicia Weaver

-

ISA-C.A.P.P. Accreditation

- Achieving the Certified Appraiser of Personal Property level reflects Alicia’s mastery of appraisal standards, methodology, and best practices.

-

IRS-Qualified & USPAP-Compliant

- Alicia’s reports stand up to scrutiny from legal and financial professionals alike, ensuring estate, tax, and insurance processes remain compliant.

-

High-Profile Clientele

- From prominent politicians to Hollywood celebrities and professional athletes, Alicia’s client list speaks to her discretion, professionalism, and white-glove service.

-

Nationwide Reach

- Traveling extensively each year, Alicia tackles large-scale projects in homes exceeding 20,000 sq. ft., offering on-site inventory and specialized appraisal solutions.

-

Mentorship & Industry Influence

- Dedicated to shaping the next generation of appraisers, Alicia mentors junior team members, ensuring Prestige Estate Services remains at the forefront of innovation and ethical standards.

Client-Centered Commitment

Alicia’s approach is defined by precision, care, and personalized service. Recognizing that appraisals often occur under sensitive circumstances—such as estate settlements or family transitions—she balances professional rigor with empathy, guiding clients step-by-step. Whether handling a single antique or an entire estate filled with art, collectibles, and furniture, Alicia’s thorough documentation and market-savvy insights ensure clients receive accurate and trusted valuations.

Contact Alicia Weaver & Prestige Estate Services

Phone: 1-844-ITEM-VAL (1-844-483-6825)

Email: Appraisals@PrestigeEstateServices.com

Website: www.PrestigeEstateServices.com

Whether you need estate tax appraisals, insurance valuations, or non-cash charitable donation appraisals, Alicia Weaver and her team deliver the professionalism, expertise, and nationwide coverage you can rely on. From consulting to brokerage and expert witness testimony, Prestige Estate Services stands ready to uphold the highest standards in personal property appraisals—carrying forward Alicia’s vision of excellence, integrity, and unmatched client satisfaction.

How Personal Property Appraisals Work & Why They Matter

Setting the Stage

Personal property appraisals provide professional valuations of tangible assets – from antique furniture and artwork to machinery and equipment. These detailed assessments determine an item’s worth based on market conditions, physical condition, and historical significance.

Your personal belongings hold both sentimental and monetary value. A professional appraisal, such as those offered by ISA appraisers, transforms this abstract worth into concrete figures you can use for:

- Insurance coverage

- Estate planning

- Tax purposes

- Legal proceedings

- Sale negotiations

- Charitable donations, through a charitable donation appraisal

Making informed financial decisions requires accurate information about your assets’ value. A thorough understanding of the appraisal process empowers you to:

- Protect your investments

- Maximize tax benefits, especially relevant in estate tax appraisals

- Ensure fair distribution of assets

- Make strategic buying and selling decisions

- Secure appropriate insurance coverage

The right appraisal can mean the difference between undervaluing precious heirlooms and receiving their true worth. It’s crucial to have a trusted professional, like our experienced appraisers, who can accurately assess your assets. Let’s explore how these valuations work and why they’re essential for your financial well-being.

Understanding Personal Property Appraisals

A personal property appraisal is a professional evaluation of an item’s worth. It takes into account market research, expert knowledge, and established methods of determining value. This process is used to assess the monetary value of movable assets – items that can be physically moved without affecting their structure or worth.

Types of Items Eligible for Appraisal:

- Fine Art & Collectibles: Paintings, sculptures, rare coins, vintage wines

- Household Items: Antique furniture, designer home décor, high-end appliances, luxury textiles

- Business Assets: Industrial machinery, office equipment, commercial vehicles, specialized tools

- Personal Valuables: Jewelry, watches, designer clothing, musical instruments

Accurate valuations are important in various situations. For insurance claims, a detailed appraisal ensures you receive fair compensation for damaged or stolen items. When settling estates, precise valuations are needed to distribute assets fairly among heirs. Business owners also use appraisals for tax purposes, loan collateral, or preparing for a sale.

The value of an item can change depending on market conditions, economic factors, and shifting trends. Professional appraisers take these factors into account when assessing an item’s condition, authenticity, history, and significance. They use standardized methods to arrive at defensible valuations that can withstand scrutiny from insurance companies, legal authorities, and financial institutions.

In certain cases like estate settlements or IRS requirements, specialized appraisals such as qualified IRS estate tax appraisals are necessary. Additionally, with advancements in technology, online photo evaluations have become a convenient option for obtaining initial appraisals without the need for physical inspections.

Understanding the Appraisal Process

The process of appraising personal property involves a series of steps that are carefully designed to ensure accurate valuations. Here’s a closer look at each of these steps:

1. Initial Inspection

During this stage, the appraiser conducts a thorough physical examination of the item being appraised. This includes:

- Assessing its overall condition

- Noting any markings or unique features

- Taking photographs from multiple angles

- Recording measurements and technical specifications

2. Data Collection and Research

Once the initial inspection is complete, the appraiser moves on to gathering relevant information about the item. This involves:

- Analyzing the market for similar items

- Compiling historical sales data

- Verifying the item’s provenance (history of ownership)

- Reviewing any pertinent documentation

3. Valuation Methods

In order to determine the value of an item, appraisers typically use one or more of three main approaches:

- Market Approach: This method looks at recent sales of comparable items to establish a value.

- Cost Approach: Here, the appraiser calculates how much it would cost to replace the item and then subtracts any depreciation.

- Income Approach: This approach is used for assets that generate income, where potential future earnings are projected.

Each valuation method has its own specific applications:

- The market approach is commonly used for collectibles and art.

- The cost approach works best for machinery and equipment.

- The income approach fits income-generating assets.

4. Documentation Requirements

A professional appraisal report should include several key components:

- Detailed descriptions of the item(s) being appraised

- Supporting photographs that visually represent the condition and features

- Clear citations of research sources used in determining value

- Analysis of market data relevant to the appraisal

- Conclusions about value reached by the appraiser along with explanations of methodology employed

At Prestige Estate Services, we adhere strictly to these documentation standards as part of our commitment to maintaining compliance with USPAP (Uniform Standards of Professional Appraisal Practice). Additionally, every single appraisal we conduct undergoes peer review in order ensure accuracy and reliability final valuation.

Our expertise extends beyond just personal property appraisals; we also specialize in estate inventory and valuation appraisals as well as charitable donation appraisals. These specialized services provide fair market values for donated items which can be used for appropriate IRS deductions purposes. Furthermore, we offer insurance appraisals designed help clients obtain adequate coverage their valuable possessions.

Key Definitions in Appraisal Valuation Methods

Understanding different valuation methods is crucial for accurate personal property appraisals. Let’s explore three primary valuation definitions that shape the appraisal landscape:

1. Fair Market Value (FMV)

- The price a willing buyer would pay a willing seller in an open market

- Both parties have reasonable knowledge of relevant facts

- Neither party acts under compulsion to buy or sell

- Example: An antique chair valued at $5,000 FMV represents its worth in a typical sale between informed parties

2. Forced Liquidation Value (FL)

- Represents the value when assets must be sold quickly

- Typically results in lower prices due to time constraints

- Common in bankruptcy or emergency situations

- The same antique chair might only fetch $2,000 in a forced sale

3. Orderly Liquidation Value (OL)

- Price obtained when assets are sold over a reasonable time period

- Allows for proper marketing and buyer exposure

- Falls between FMV and FL values

- Our antique chair example might sell for $3,500 under orderly liquidation

These valuation methods serve different purposes in real-world scenarios:

- Insurance Claims: FMV helps determine appropriate coverage and replacement costs

- Estate Sales: OL guides pricing strategy when time allows for organized sales

- Bankruptcy Proceedings: FL reflects realistic values in immediate liquidation situations

Professional appraisers at Prestige Estate Services apply these methods based on specific circumstances and client needs. Each valuation approach considers market conditions, item condition, and intended use of the appraisal.

The Importance of Personal Property Appraisals in Financial Transactions

Personal property appraisals are essential in various financial situations, directly affecting your ability to make informed money decisions. Here’s how appraisals impact different financial aspects:

1. Loan Security and Interest Rates

- Banks use appraisals to determine the collateral value of personal property

- Accurate valuations help secure better interest rates on loans

- Lenders assess risk levels based on professional appraisal reports

- You can leverage high-value items for business financing or personal loans

2. Insurance Coverage Benefits

- Professional appraisals ensure adequate coverage for valuable items

- Insurance companies rely on detailed appraisal reports for claim processing

- Regular updates help maintain appropriate coverage as values change

- Written documentation speeds up the claims settlement process

3. Estate Distribution Process

Appraisals provide fair market values for equitable asset distribution, which is especially important during estate settlements or divorce proceedings. For such cases, Prestige offers fair and impartial equitable distribution appraisals that ensure each heir receives their fair share while minimizing potential conflicts.

- Heirs receive their rightful share based on accurate valuations

- Tax implications can be properly assessed and planned for

- Prevents potential disputes among beneficiaries during distribution

4. Real-World Applications

A client recently used a professional appraisal from Prestige Estate Services to secure a business loan using their antique collection as collateral. The detailed valuation report helped them obtain favorable loan terms and demonstrated the collection’s true worth to the lender.

Personal property appraisals also protect your financial interests during life changes. When dividing assets in estate settlements, professional valuations ensure each heir receives their fair share while minimizing potential conflicts. Your insurance coverage remains current and accurate with regular appraisal updates, protecting your investments against unexpected losses.

Factors Influencing Appraisal Values: A Closer Look

The value of personal property fluctuates based on multiple critical factors that professional appraisers must carefully evaluate. Physical deterioration stands as a primary consideration – scratches, wear patterns, and structural damage can significantly impact an item’s worth. Economic obsolescence also plays a vital role, as technological advances or changes in market preferences can render certain items less valuable.

Key Depreciation Factors:

- Natural aging and wear

- Environmental damage

- Outdated technology

- Market demand shifts

- Functional obsolescence

Craftsmanship quality serves as a fundamental value determinant. Items showcasing exceptional workmanship, premium materials, and meticulous attention to detail command higher valuations. Expert appraisers assess:

- Material authenticity

- Construction techniques

- Finishing methods

- Artistic execution

- Structural integrity

Historical significance and provenance add substantial value layers to personal property. Items with documented historical connections or prestigious ownership histories often attract premium valuations. Appraisers examine:

- Authentication documents

- Historical records

- Chain of ownership

- Cultural significance

- Rarity in historical context

The market’s current state influences these factors’ weight in the final valuation. Certain periods may see increased demand for specific craftsmanship styles or historical pieces, while others might prioritize functionality and condition. Professional appraisers stay current with market trends to provide accurate valuations reflecting these dynamic influences.

Choosing the Right Appraiser: What You Need to Know

Selecting a qualified appraiser requires careful consideration of specific credentials and professional standards. Here’s what you need to look for:

Essential Qualifications:

- Membership in the International Society of Appraisers (ISA)

- Compliance with USPAP (Uniform Standards of Professional Appraisal Practice)

- Specialized training in specific property types

- Active participation in professional organizations

- Documented experience in your item category

Red Flags to Watch For:

- Reluctance to provide credentials

- Offering to purchase items they’re appraising

- Lack of proper documentation methods

- Missing or outdated certifications

- Inability to explain valuation methods

Your chosen appraiser should demonstrate thorough knowledge of current market trends and maintain detailed records of their research methods. Professional appraisers use standardized approaches, including market comparison analysis, cost approach evaluations, and income-based assessments.

A qualified appraiser provides:

- Written reports meeting USPAP standards

- Clear explanation of valuation methods

- Detailed documentation of item condition

- Current market analysis

- References from previous clients

The right professional stays current with market fluctuations through continuous education and networking within their specialty areas. They maintain memberships in relevant professional organizations and can prove their expertise through proper certification and licensing.

For those seeking full or partial estate valuations, it’s crucial to find an appraiser who can provide an Estate Inventory & Valuation Report that adheres to IRS and USPAP standards.

Common Misconceptions About Personal Property Appraisals Debunked

Let’s dispel some persistent myths about personal property appraisals that can lead to costly mistakes:

Myth #1: All appraisers are equally qualified The truth is appraisers specialize in specific areas. For instance, our appraisers who are experts in fine art might not be the best choice for evaluating antique machinery. You need an appraiser with specific expertise in your item category.

Myth #2: Online valuations are as reliable as professional appraisals While online research can provide rough estimates, it can’t replace a professional appraiser’s trained eye and access to comprehensive market data. Many factors affecting value require physical inspection.

Myth #3: Age equals value Just because an item is old doesn’t automatically make it valuable. The true value depends on multiple factors:

- Condition

- Rarity

- Historical significance

- Market demand

- Authenticity

Myth #4: Appraisals and selling prices are identical An appraisal provides a value opinion based on specific criteria and market conditions. The actual selling price can vary depending on:

- The selling venue

- Time constraints

- Economic conditions

- Buyer interest

Myth #5: Insurance appraisals and fair market value appraisals are the same Different purposes require different valuation approaches. Insurance appraisals typically reflect replacement cost, while fair market value appraisals consider what a willing buyer would pay in the current market.

The Role of Prestige Estate Services in the Appraisal Industry

Prestige Estate Services sets industry standards through rigorous training and unwavering commitment to excellence. Their team of ISA-certified and USPAP-compliant appraisers undergoes continuous education to stay current with market trends and valuation methodologies.

The company’s comprehensive approach includes:

- Specialized Training Programs: Regular workshops and certification updates for staff members

- Quality Assurance: Strict adherence to USPAP standards and IRS regulations

- Diverse Expertise: Appraisers trained across multiple disciplines, from fine art to antique furniture

- Client-Focused Service: Personalized attention throughout the appraisal process

Their nationwide network of professional appraisers delivers accurate valuations for insurance, estate planning, and charitable donations. For instance, their estate tax appraisal services can be instrumental when inventorying a property for IRS estate tax purposes. Whether conducting on-site assessments or providing digital photo valuations, Prestige Estate Services maintains the highest professional standards in personal property appraisals.

FAQs (Frequently Asked Questions)

What is a personal property appraisal?

A personal property appraisal is a professional assessment that determines the value of personal items, such as machinery, equipment, and antiques. It plays a crucial role in financial decisions by providing accurate valuations for various scenarios, including insurance claims and estate settlements.

What are the different types of appraisals?

Personal property appraisals can vary widely depending on the type of item being evaluated. Common types include appraisals for machinery, equipment, antiques, and collectibles. Each type requires specific methodologies to ensure accurate valuation.

What is the significance of Fair Market Value (FMV) in appraisals?

Fair Market Value (FMV) represents the price that an item would sell for on the open market between a willing buyer and seller. Understanding FMV is essential for both buyers and sellers to make informed financial decisions during transactions.

How does the appraisal process work?

The appraisal process typically involves several steps: initial inspections, data collection, and employing valuation techniques such as the market approach, cost approach, or income approach. Thorough research and documentation are vital for achieving reliable results.

What factors influence appraisal values?

Several factors can affect appraisal values, including physical deterioration, craftsmanship quality, economic obsolescence, and historical significance. Each of these elements can significantly impact how an item’s worth is assessed.

How do I choose a qualified appraiser?

When selecting a qualified appraiser, look for relevant certifications such as ISA membership or compliance with USPAP standards. Professional expertise is crucial to ensure accurate valuations and reliable results in your appraisal process.

Phone: 1-844-ITEM-VAL (1-844-483-6825)

Email: Appraisals@PrestigeEstateServices.com

Website: www.PrestigeEstateServices.com

Experience Matters

Contact Us

Ready to explore the Prestige Estate Services difference? Contact us.

Get in Touch

We’d love to discuss your specific estate sale and appraisal needs.